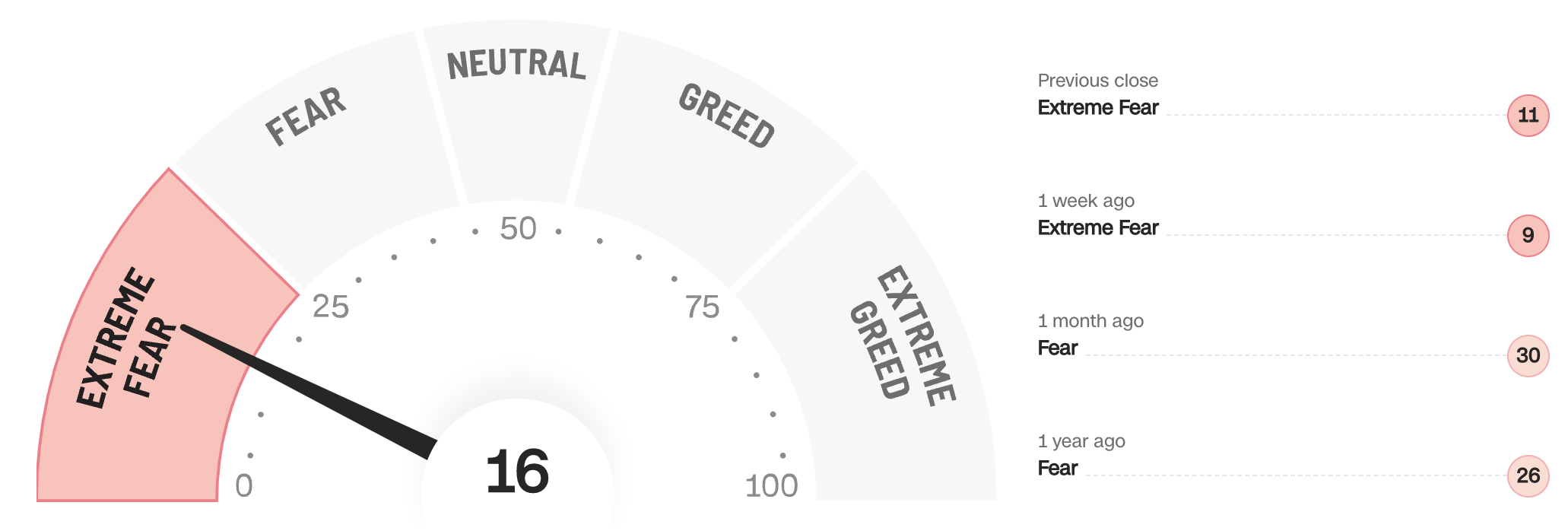

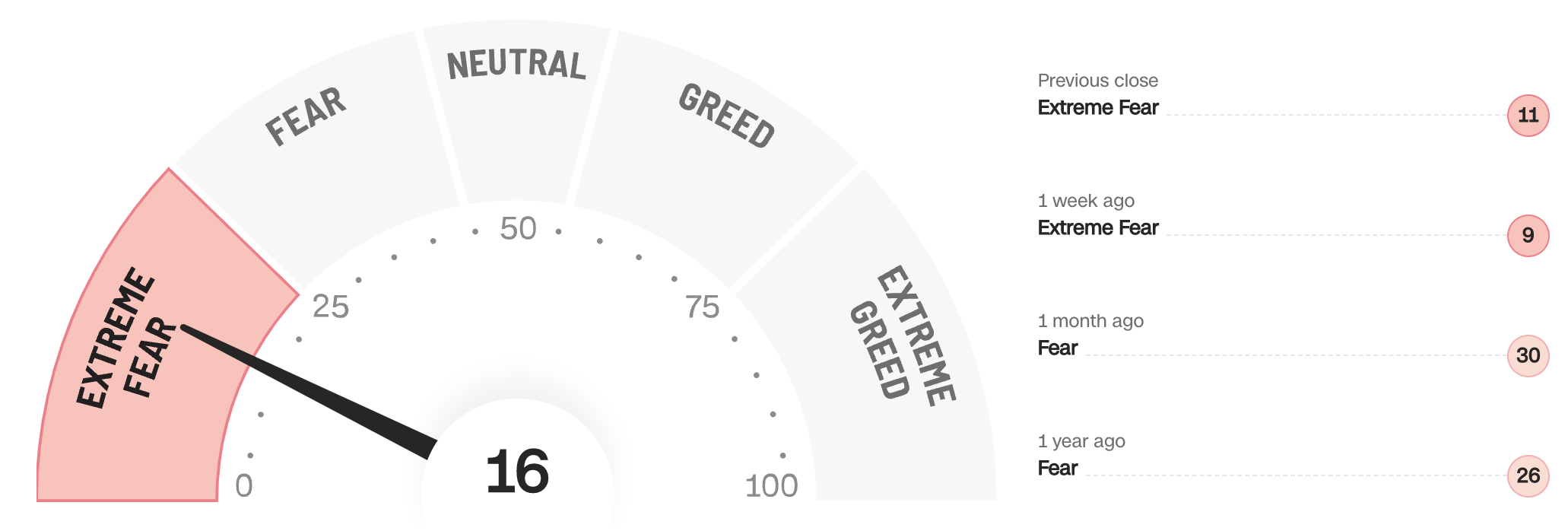

It’s unofficially official: we’re in a recession. How long it lasts and how bad it gets are up for debate, but we have officially entered the land of low consumer confidence, skyrocketing interest rates, lingering logistics challenges across the Pacific, six dollar gas, and the general public slowly realizing that maybe all that free money in 2020 wasn’t really free.

But now that we’re here, there are lessons to be learned. History does in fact repeat itself.

Marketing leaders are going to react in one of three ways: attempting to “ride it out” and maintaining spend, cutting ad spend significantly (if not entirely), or doubling down on plummeting CPM rates and “buying low” on the attention of their target audiences. There are risks and rewards for each approach.

Looking back at 2008, 60% of brands went dark and cut their TV presence entirely for six months or more at the height of the economic downturn. According to a McKinsey report, ad spend didn’t recover to 2007 levels until 2011 after the 2008 recession. In March 2020 when COVID hit, paid social ad spend dropped 33% and paid search dropped 30%. The DTC revolution and temporary stimulus boost fueled a much faster recovery on spend levels. As it turns out, if you give consumers $1,200 checks from the government, they’ll find ways to spend them.

This time around, no such stimulus checks will come en masse. The $400 checks Californians are about to receive to “help ease the burden at the pump” will hardly offset fuel costs for a month for most commuters, and in my personal estimation will be used by most consumers to pay off credit card debt that has accumulated via lifestyles that have not adjusted to accommodate paychecks that don’t go as far as they did just five months ago. As such, coupled with

ongoing attribution challenges, more marketing leaders are cutting ad budgets, agency relationships, and department payrolls in a hybrid approach of riding it out and throwing enough weight overboard in an effort to keep their boat afloat.

But your mother was right: “everybody else is doing it” is never a great reason to follow suit.

This approach is fueled by false confidence. Brand awareness and loyalty that’s been built for years doesn’t go away overnight just because an ad budget is scaled back. The draining of a brand’s competitive moat occurs over time, and much like the proverbial frog sitting in gradually boiling water, many marketers will fail to react in time to avoid significant long-term setbacks to the brand.

According to

McGraw Hill, a study of 600 companies from 1980 to 1985 revealed that those that maintained or increased their ad spend following the 1981 recession outperformed those that didn’t by 265% over that time period.

Here Come the Challenger Brands.

All this said, recessions are incredible opportunities for challenger brands that have the fiscal resources and courage at the C-level to meaningful gains in market share. In the 1920s, Kellogg’s increased ad spend and launched new products, leading to its dominance over Post for decades to come. Toyota increased ad spend during the 1973 recession and was the top imported manufacturer by 1976. In 1991, McDonalds (28% loss) opened the door for Pizza Hut (61% growth) and Taco Bell (40% growth) to gain a stronger foothold in fast food when it scaled back its ad budget.

Regardless of where your brand sits today, you’re going to need a Strategic Partner to help you navigate yet another “new normal” for marketing leaders.

Let’s

connect!

But now that we’re here, there are lessons to be learned. History does in fact repeat itself.

Marketing leaders are going to react in one of three ways: attempting to “ride it out” and maintaining spend, cutting ad spend significantly (if not entirely), or doubling down on plummeting CPM rates and “buying low” on the attention of their target audiences. There are risks and rewards for each approach.

Looking back at 2008, 60% of brands went dark and cut their TV presence entirely for six months or more at the height of the economic downturn. According to a McKinsey report, ad spend didn’t recover to 2007 levels until 2011 after the 2008 recession. In March 2020 when COVID hit, paid social ad spend dropped 33% and paid search dropped 30%. The DTC revolution and temporary stimulus boost fueled a much faster recovery on spend levels. As it turns out, if you give consumers $1,200 checks from the government, they’ll find ways to spend them.

This time around, no such stimulus checks will come en masse. The $400 checks Californians are about to receive to “help ease the burden at the pump” will hardly offset fuel costs for a month for most commuters, and in my personal estimation will be used by most consumers to pay off credit card debt that has accumulated via lifestyles that have not adjusted to accommodate paychecks that don’t go as far as they did just five months ago. As such, coupled with ongoing attribution challenges, more marketing leaders are cutting ad budgets, agency relationships, and department payrolls in a hybrid approach of riding it out and throwing enough weight overboard in an effort to keep their boat afloat.

But your mother was right: “everybody else is doing it” is never a great reason to follow suit.

This approach is fueled by false confidence. Brand awareness and loyalty that’s been built for years doesn’t go away overnight just because an ad budget is scaled back. The draining of a brand’s competitive moat occurs over time, and much like the proverbial frog sitting in gradually boiling water, many marketers will fail to react in time to avoid significant long-term setbacks to the brand.

According to McGraw Hill, a study of 600 companies from 1980 to 1985 revealed that those that maintained or increased their ad spend following the 1981 recession outperformed those that didn’t by 265% over that time period.

Here Come the Challenger Brands.

All this said, recessions are incredible opportunities for challenger brands that have the fiscal resources and courage at the C-level to meaningful gains in market share. In the 1920s, Kellogg’s increased ad spend and launched new products, leading to its dominance over Post for decades to come. Toyota increased ad spend during the 1973 recession and was the top imported manufacturer by 1976. In 1991, McDonalds (28% loss) opened the door for Pizza Hut (61% growth) and Taco Bell (40% growth) to gain a stronger foothold in fast food when it scaled back its ad budget.

Regardless of where your brand sits today, you’re going to need a Strategic Partner to help you navigate yet another “new normal” for marketing leaders.

Let’s connect!

But now that we’re here, there are lessons to be learned. History does in fact repeat itself.

Marketing leaders are going to react in one of three ways: attempting to “ride it out” and maintaining spend, cutting ad spend significantly (if not entirely), or doubling down on plummeting CPM rates and “buying low” on the attention of their target audiences. There are risks and rewards for each approach.

Looking back at 2008, 60% of brands went dark and cut their TV presence entirely for six months or more at the height of the economic downturn. According to a McKinsey report, ad spend didn’t recover to 2007 levels until 2011 after the 2008 recession. In March 2020 when COVID hit, paid social ad spend dropped 33% and paid search dropped 30%. The DTC revolution and temporary stimulus boost fueled a much faster recovery on spend levels. As it turns out, if you give consumers $1,200 checks from the government, they’ll find ways to spend them.

This time around, no such stimulus checks will come en masse. The $400 checks Californians are about to receive to “help ease the burden at the pump” will hardly offset fuel costs for a month for most commuters, and in my personal estimation will be used by most consumers to pay off credit card debt that has accumulated via lifestyles that have not adjusted to accommodate paychecks that don’t go as far as they did just five months ago. As such, coupled with ongoing attribution challenges, more marketing leaders are cutting ad budgets, agency relationships, and department payrolls in a hybrid approach of riding it out and throwing enough weight overboard in an effort to keep their boat afloat.

But your mother was right: “everybody else is doing it” is never a great reason to follow suit.

This approach is fueled by false confidence. Brand awareness and loyalty that’s been built for years doesn’t go away overnight just because an ad budget is scaled back. The draining of a brand’s competitive moat occurs over time, and much like the proverbial frog sitting in gradually boiling water, many marketers will fail to react in time to avoid significant long-term setbacks to the brand.

According to McGraw Hill, a study of 600 companies from 1980 to 1985 revealed that those that maintained or increased their ad spend following the 1981 recession outperformed those that didn’t by 265% over that time period.

Here Come the Challenger Brands.

All this said, recessions are incredible opportunities for challenger brands that have the fiscal resources and courage at the C-level to meaningful gains in market share. In the 1920s, Kellogg’s increased ad spend and launched new products, leading to its dominance over Post for decades to come. Toyota increased ad spend during the 1973 recession and was the top imported manufacturer by 1976. In 1991, McDonalds (28% loss) opened the door for Pizza Hut (61% growth) and Taco Bell (40% growth) to gain a stronger foothold in fast food when it scaled back its ad budget.

Regardless of where your brand sits today, you’re going to need a Strategic Partner to help you navigate yet another “new normal” for marketing leaders.

Let’s connect!